Understanding Buy‑Sell Agreements & Insurance Funding

Understanding Buy‑Sell Agreements | Ownership Continuity Education

Explore the strategic purpose of Buy‑Sell Agreements and how businesses plan for ownership continuity with this educational overview from V‑Minds.

Understanding Buy‑Sell Agreements & Insurance Funding

A Buy‑Sell Agreement is a legal contract that outlines how ownership transitions occur if an owner passes away, becomes disabled, or leaves the business.

V‑Minds helps you understand the concept — not the legal, tax, or insurance structure behind it.

🔑 Educational Scenario: Planning for Ownership Continuity

Sam and Riley, co‑owners of a small business, realize they need to plan for predictable transitions. During a meeting with their attorney and licensed financial professionals, they learn about Buy‑Sell Agreements and how these agreements help define ownership transfer rules.

Their discussion focuses on:

- identifying long‑term goals

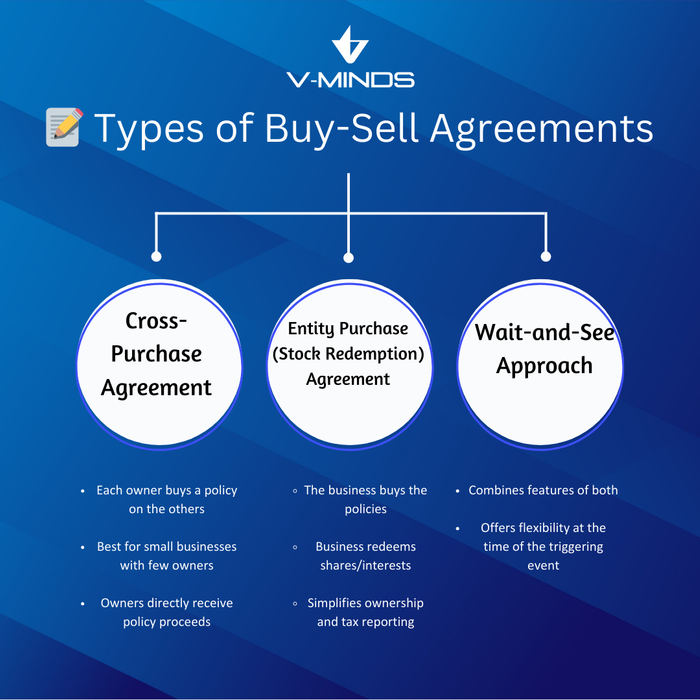

- understanding the types of Buy‑Sell structures

- reviewing possible funding concepts at a general level

No funding method is selected. No insurance product is discussed in detail.

Takeaway:

This scenario helps visitors understand the strategic purpose of Buy‑Sell planning without implying how it should be implemented.

💡 Questions to Ask Licensed Professionals

• Which agreement structure fits our business?

• What legal language must be included?

• What funding options should we consider?

• What are the tax implications?

📝How V‑Minds Helps

We clarify your thinking so you can have focused, productive conversations with attorneys and licensed advisors.

Universal Disclaimer for All Pages

Disclaimer:

The information provided by V‑Minds is for general educational and strategic‑planning purposes only. V‑Minds does not sell insurance products, recommend specific policies, provide suitability assessments, or offer legal, tax, investment, or financial advice. All product‑specific decisions — including the evaluation, purchase, design, or modification of any insurance policy — must be made in consultation with licensed insurance professionals and qualified legal or tax advisors.