Executive Bonus Plan

Executive Bonus Plans: A Smart, Tax-Advantaged Strategy for Attracting and Retaining Top Talent

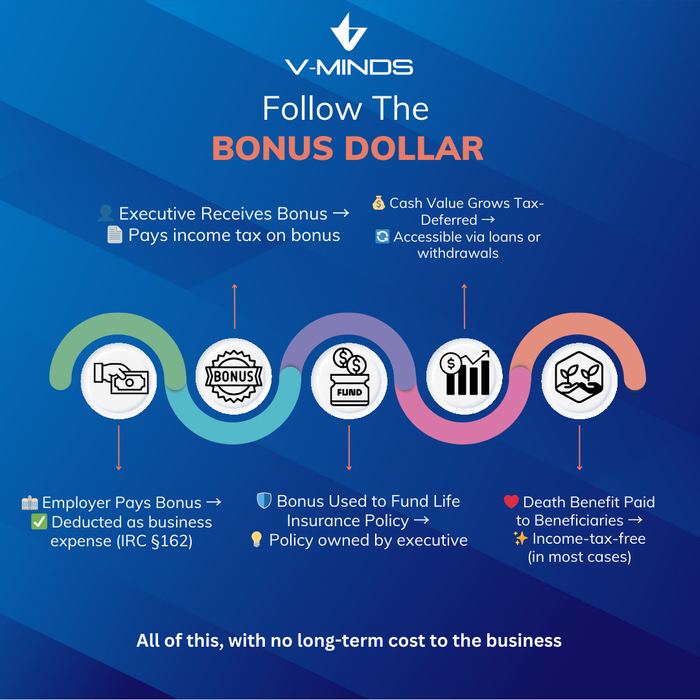

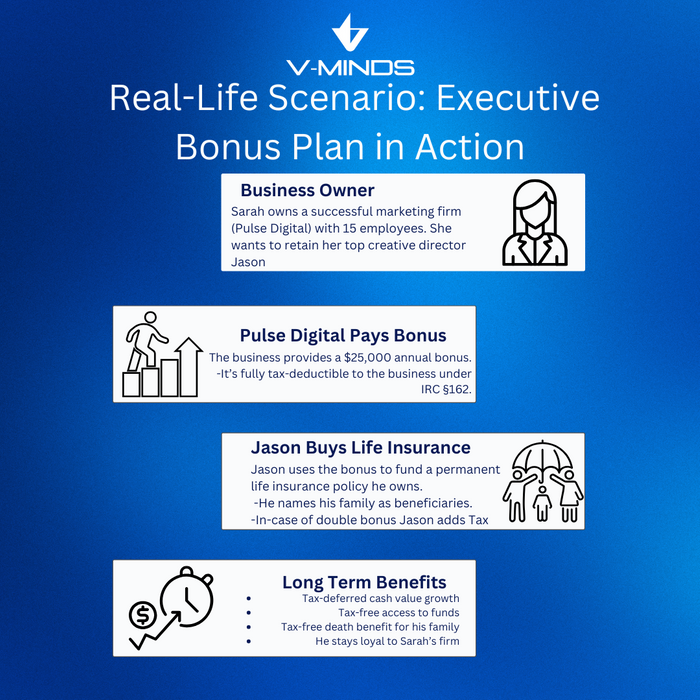

In today’s competitive business environment, attracting and retaining key executives is more challenging than ever. An Executive Bonus Plan (IRC §162 Bonus Arrangement) is a flexible, tax-advantaged tool that allows employers to reward top performers while enjoying immediate tax benefits. This simple yet powerful strategy aligns the interests of the business and the executive—without the complexity of traditional deferred compensation plans.

What Is an Executive Bonus Plan?

An Executive Bonus Plan is a compensation arrangement where the employer provides a bonus to a selected executive, which is used to purchase a permanent life insurance policy. The executive owns the policy and names their beneficiaries, while the employer pays the premiums as a deductible bonus.

Key Tax Benefits for Employers

1. Immediate Tax Deduction

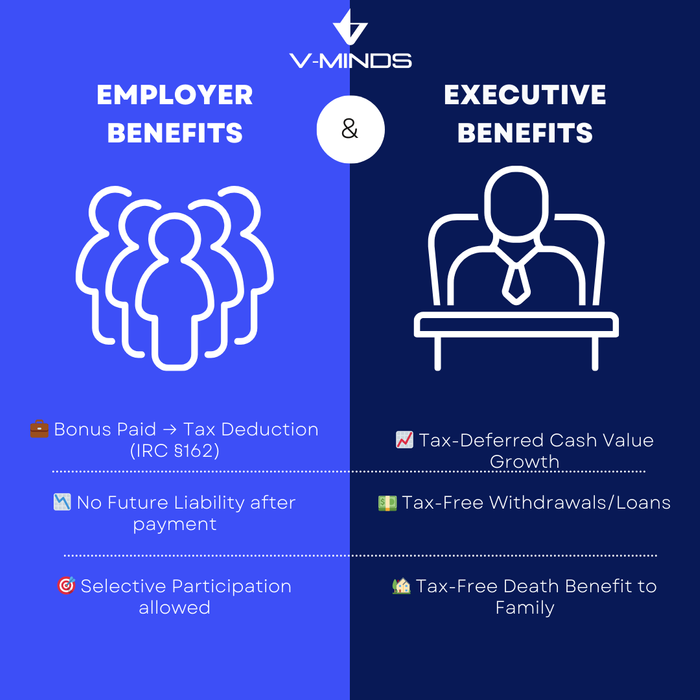

Under IRC §162, the bonus paid to the executive is treated as reasonable compensation and is fully deductible to the business in the year it is paid—just like a salary or regular bonus.

2. No Long-Term Liability

Unlike traditional retirement plans or deferred compensation arrangements, the Executive Bonus Plan does not create a future obligation for the company. Once the bonus is paid, the business has no further liabilities related to the arrangement.

3. Selective Participation

This plan is not subject to ERISA or nondiscrimination rules, so employers can selectively reward only key employees or executives, offering a powerful incentive to retain top talent without needing to offer benefits to all staff.

Tax Benefits for Executives

1. Tax-Deferred Growth

The life insurance policy grows tax-deferred, allowing the executive to accumulate cash value over time.

2. Tax-Free Access

Executives may access the policy’s cash value through tax-free loans or withdrawals, if structured properly, providing a future source of supplemental income.

3. Tax-Free Death Benefit

The death benefit is generally income-tax-free to the executive’s named beneficiaries, creating a valuable estate planning benefit.

Is An Executive Bonus Plan Right for Your Business?

An Executive Bonus Plan is ideal for closely held businesses, professional firms, and corporations looking for a tax-efficient way to reward leadership without the red tape of qualified plans. It offers a win-win structure: a tax deduction for the business and a valuable benefit for the executive. Contact V-Minds today to learn more!